Treasury Bond Ladder Etf

But some exchange traded funds have found a work around holding portfolios of bonds that all mature in a.

Treasury bond ladder etf. Income seeking investors can get exposure to bonds through mutual funds exchange traded funds etfs and for those with sufficient assets individual bonds. In addition to expense ratio and issuer information this table displays platforms that offer commission free trading for certain etfs. But etf bond ladders offer tremendous diversification inside of the maturity window you re looking at. Ibonds etfs make it is easy to create scalable bond ladders with only a few etfs rather than trading numerous bonds.

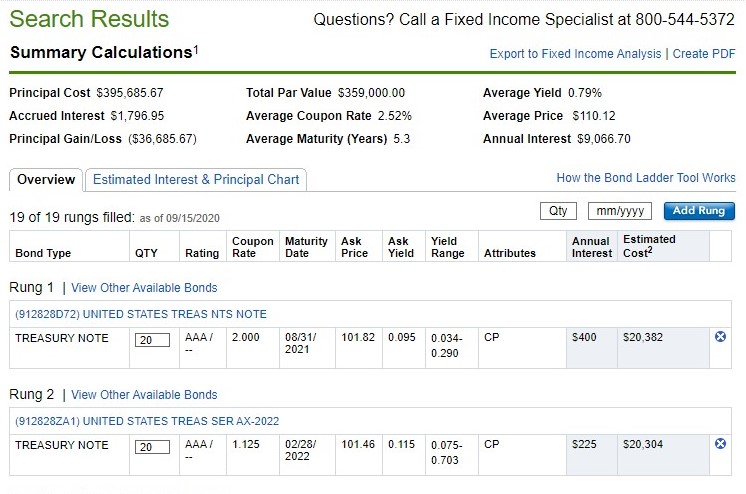

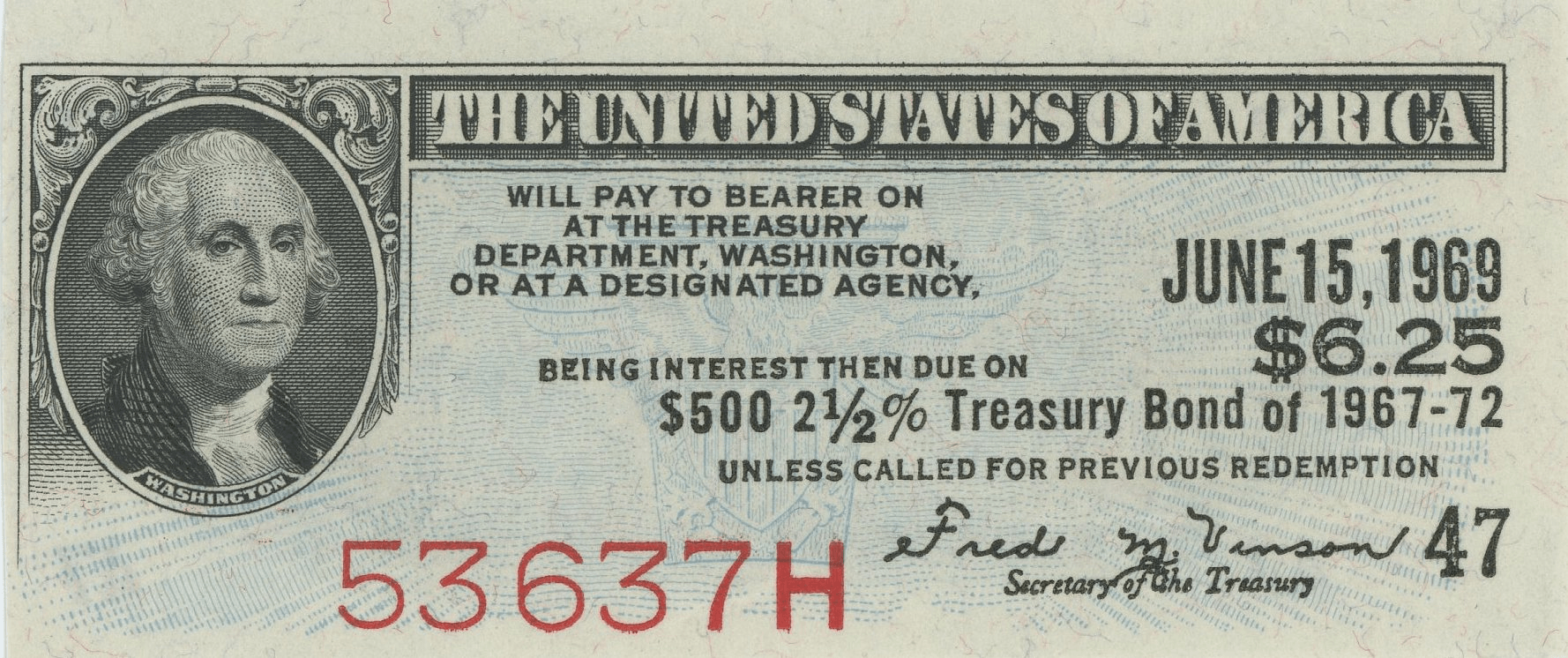

Fidelity s bond ladder tool can help self directed investors build ladders. Bond funds don t work for ladders because the bonds in them are rarely held to maturity. Benchmark on 7 1 2016 govt began to track the ice u s. Ladders should be built with high quality noncallable bonds.

Exchanges that are currently tracked by etf database. Research performance expense ratio holdings and volatility to see if. Treasury core bond index. Index data on or after 7 1 2016 is for the ice u s.

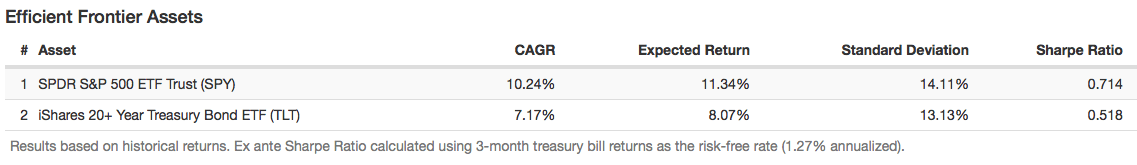

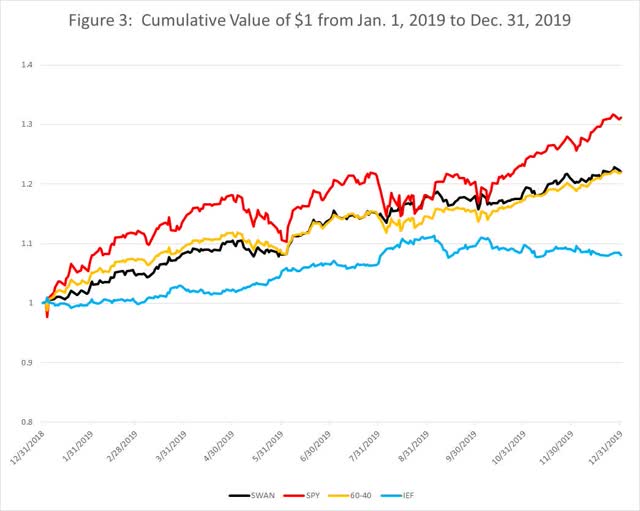

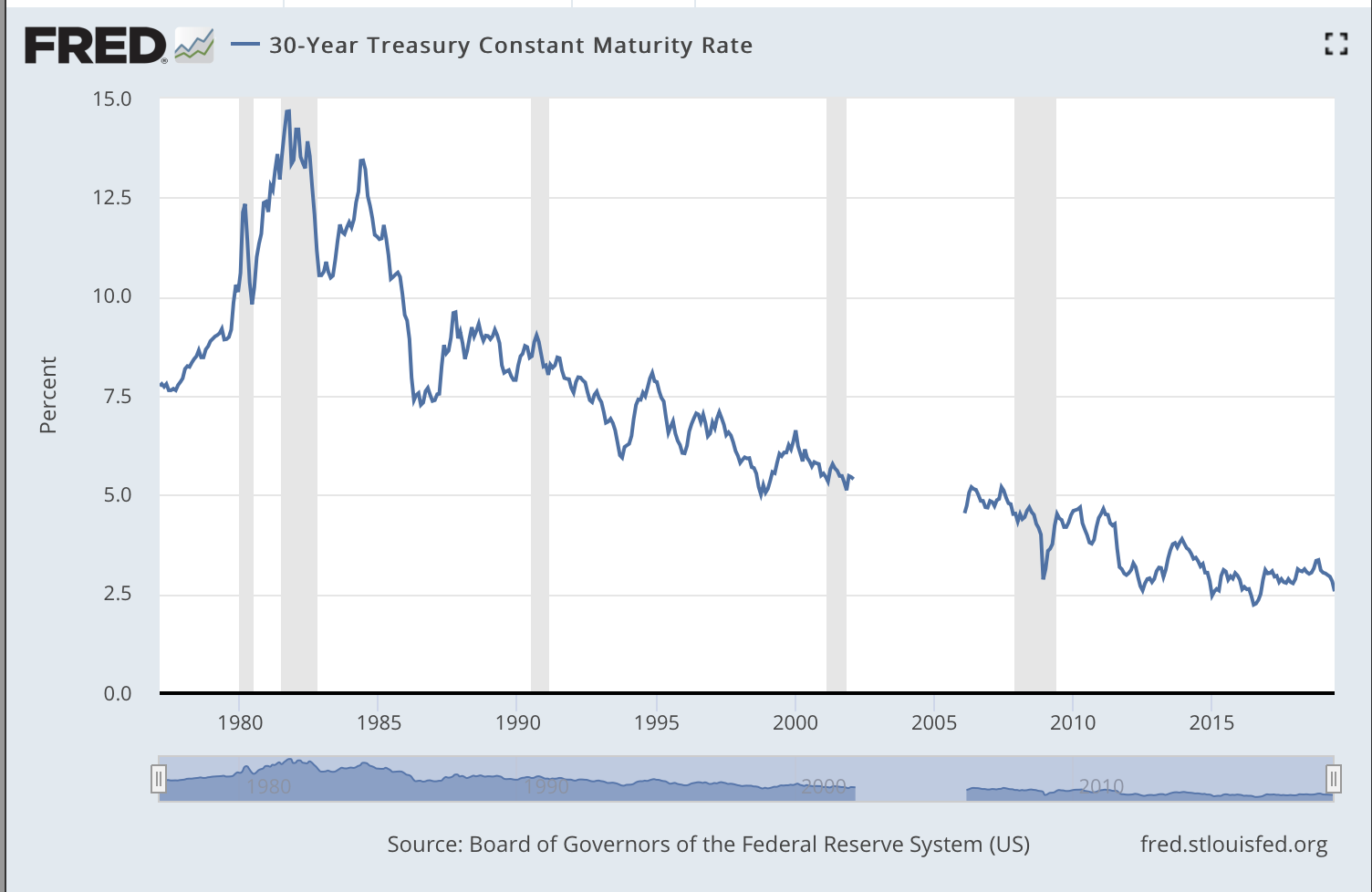

10 46 5 59 4 07 2 94 after tax pre liq. Building bond ladders with bulletshares etfs one way to generate stable income and protect against rising interest rates is through a bond ladder. For example a treasury etf holding three to seven year treasury bonds. Learn everything you need to know about invesco 1 30 laddered treasury etf plw and how it ranks compared to other funds.

Historical index data prior to 7 1 2016 is for the barclays u s. Pick points on the yield curve. The etfs that most closely match the investment results of a bond ladder are the target maturity treasury security etfs. For me it s still a comparison against individual bond ladders where if you re thinking of.

Treasury core bond index. Return after taxes on distributions. Take a video tour of the bond ladder tool and learn how you can build a portfolio of bonds to help create a consistent stream of income over time. Learn about using bond ladders barbells and bullets to help diversify across maturity dates when investing in individual bonds.